More products and services

We've upgraded our wealth management services with technology and enhanced support:

- New interface for a more personal experience

- Upgraded wealth support for investing

- Global transfer launched for easier transfers

- Optimised layout to improve efficiency

- Enhanced customer service and support

Highlights at a glance

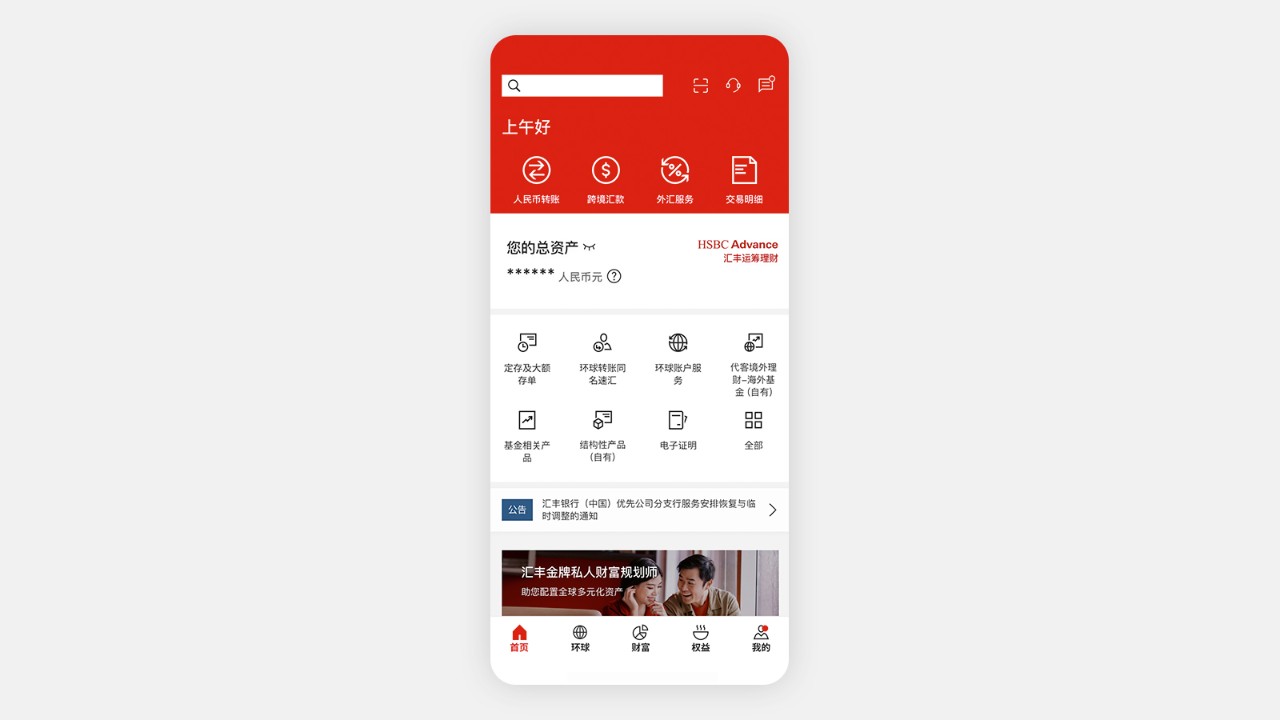

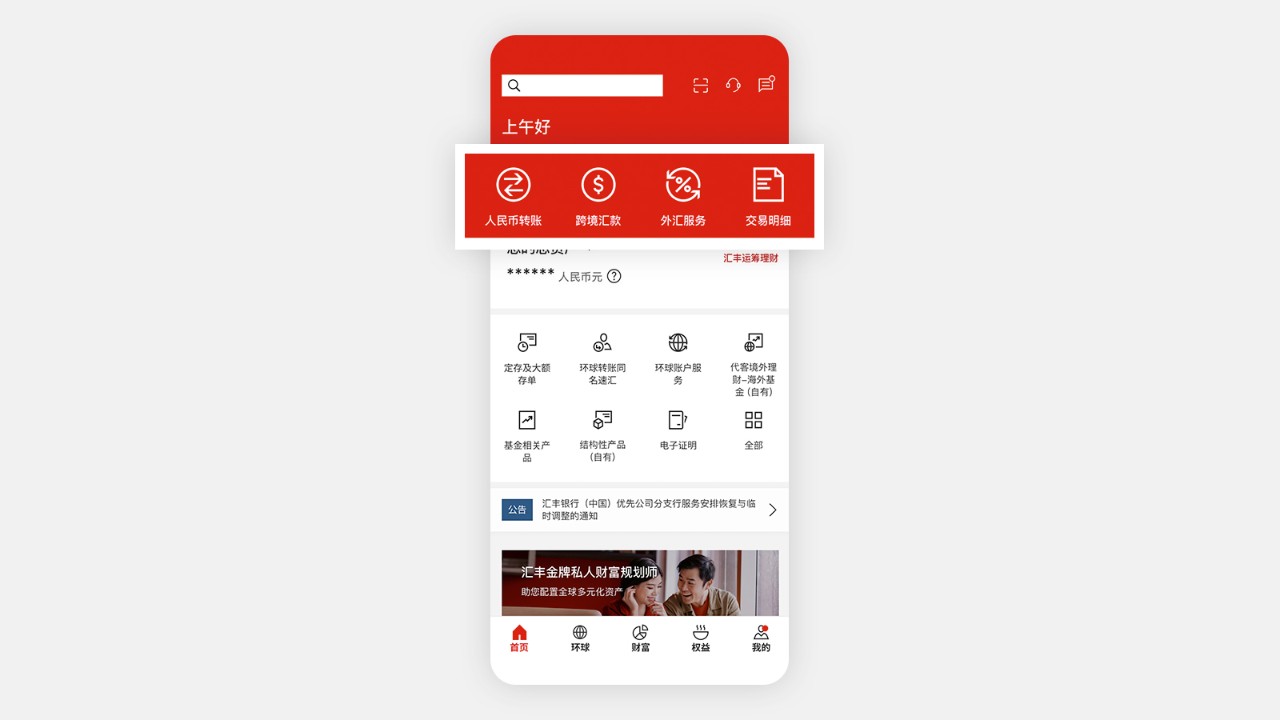

New interface for a more personal experience

- Reimagined based on local user habits and needs of different account types

- 5 support sections to cover all our products and services

- Optimised search engine for a smarter way to access your information more efficiently

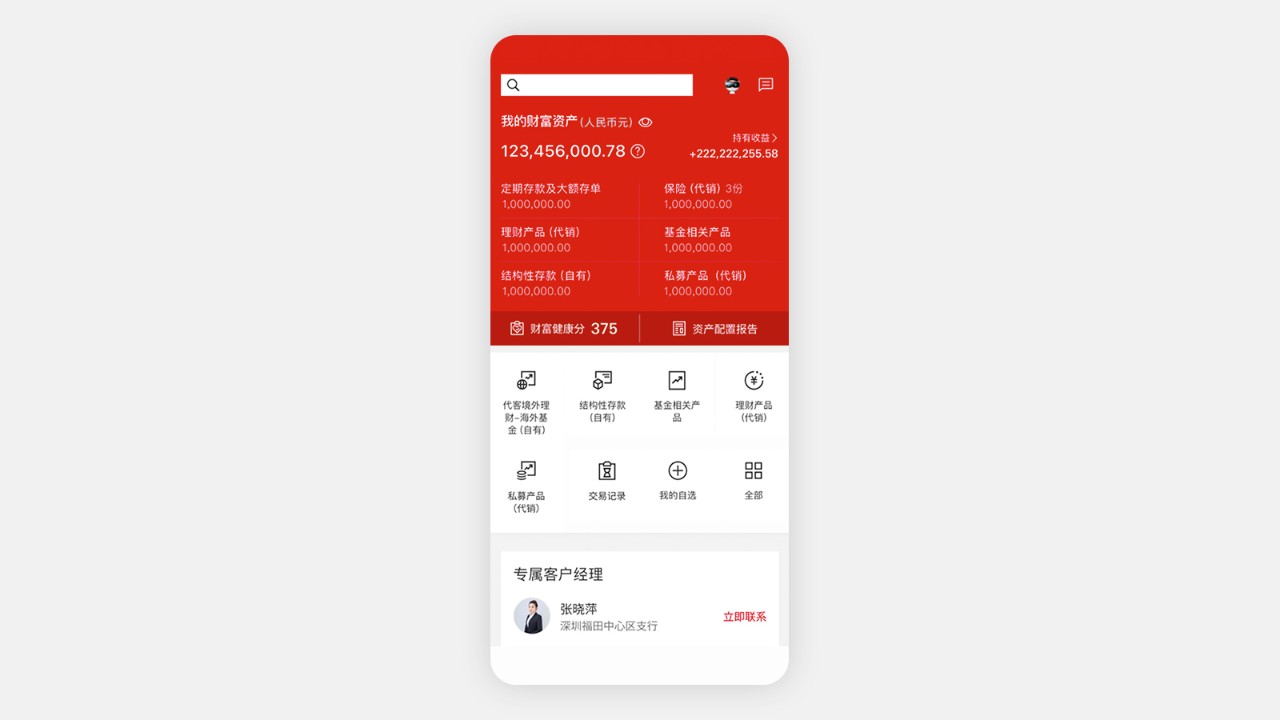

Upgraded wealth support for investing

- Fund selector: search for funds with 1 tap and screen available funds with our quick filtering and sorting features

- Upgraded product shelf: a wide selection of investment products for different needs

- HSBC Wealth Management Connect: exclusive cross-border investment channel for residents in the Greater Bay Area

- More wealth tools: digitalised management tools to provide you with a one-stop online support

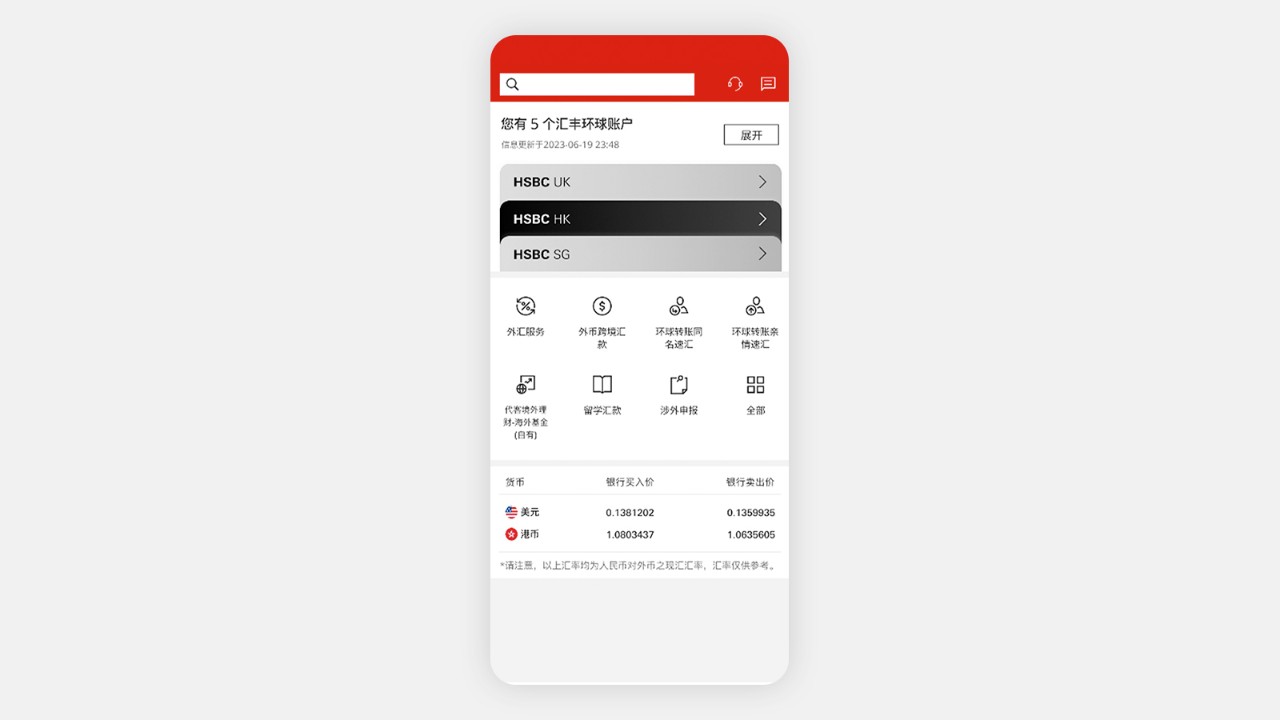

Global transfer launched for easier transfers

- Global Account: check your assets in your HSBC overseas accounts easily

- Global Transfer: view all your HSBC overseas accounts on 1 page, and make fast transfers globally to any account you hold under HSBC

- International Education Payment System: search for your school and the system will automatically match the payment account, making online remittance much easier

- Foreign currency solution: view real-time exchange rates, and enjoy convenient foreign currency exchange and investment services

Optimised layout to improve efficiency

- Pin your frequently-used features on top of the homepage for your quick checking

- A quick glance at the latest investment products on the homepage

- Set up your preferred quick entries on the homepage as you wish

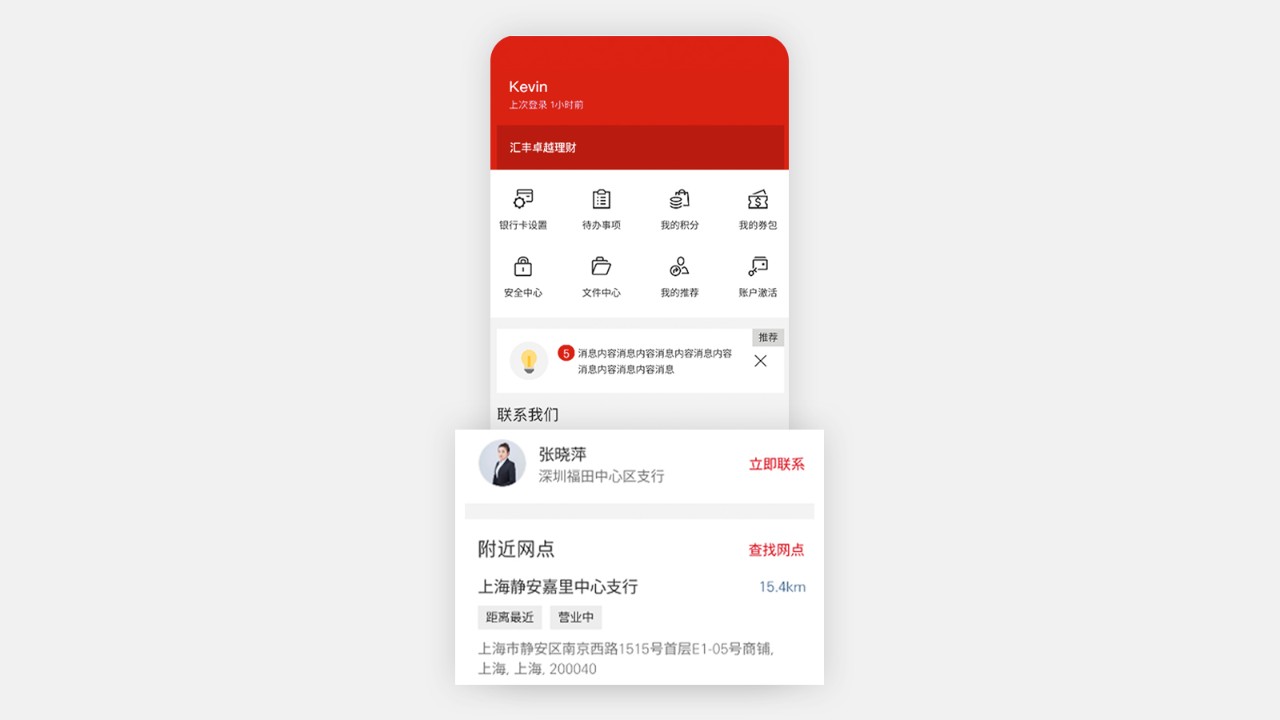

Enhanced customer service and support

- Locate your nearest branch with GPS, and search for specific services using key words

- Call our Relationship Manager with just 1 tap

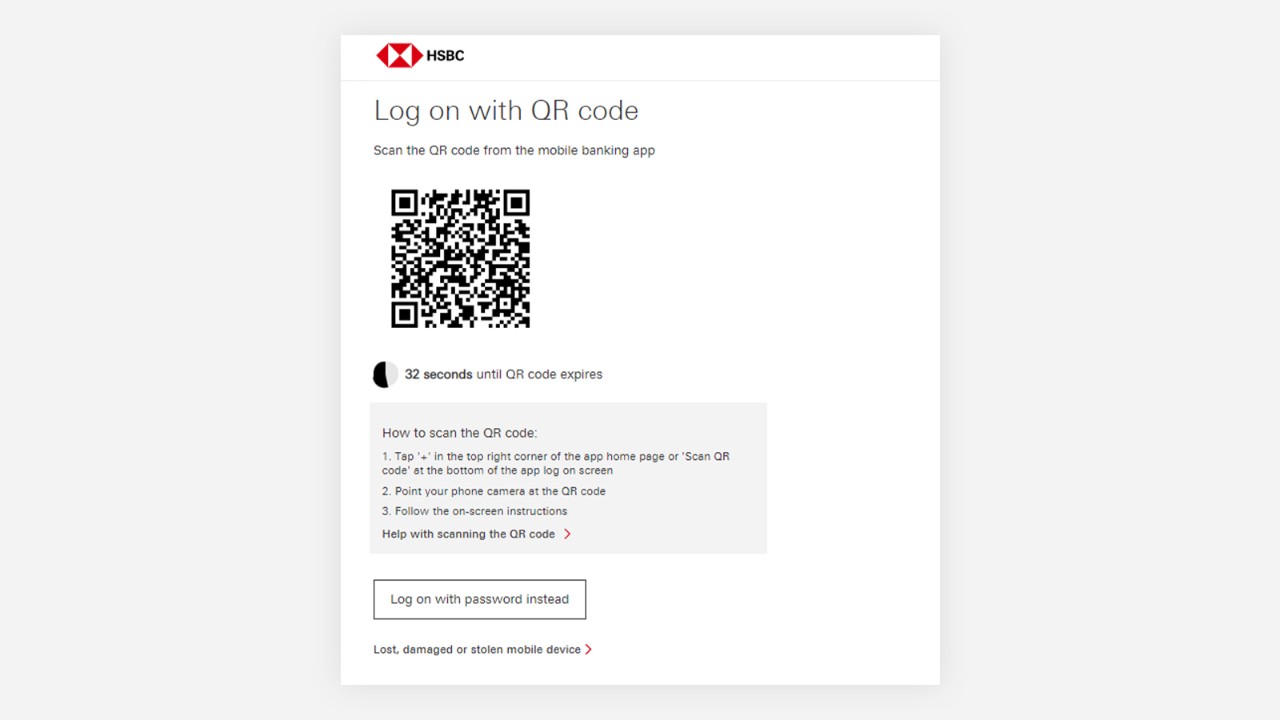

Scan the QR code now to download the HSBC China Mobile Banking app

Digital Authentication

Activate Digital Authentication on the HSBC China Mobile Banking app now to log on or make transactions without the need to carry a physical Security Device.

More features

Self service

- Electronic certificates

- View account balance

- Chat with us

Wealth management

Mobile experience

- Face ID/Touch ID

- Push notifications