Structured deposits and online trading platform

Structured Deposit (in Chinese only)

"Hui"

- Asian Up & Out

- Twin Win

- Callable Structured Deposit

"Ying"

- Autocallable with Airbag

- EU Digital

- Generic Growth

"Feng Rui"

- Convertible Non-Principal Protected Structured Deposit

"Chuang"

- Daily Sharkfin

- Memory Autocall

Structured Deposit Online Trading Platform

- Place your order at any time with ease

- After selecting your parameters, our system will provide quotes and scenario analysis immediately — day T: placing order, T+1: cooling off period is over, T+2: trading completed

- Make transactions easily by logging on to our online or mobile banking

View my investment portfolio

- How to check my investment portfolio

You can log on to your online banking and click 'Wealth Dashboard', or check 'My holdings' via your mobile banking app - What kind of parameters are there?

You can check product performance, annual returns, holdings of your investment products, profit and loss of each major type of assets, a complete review of the investment portfolio, and track the performance of the underlying asset

Structured deposits

What is structured deposit?

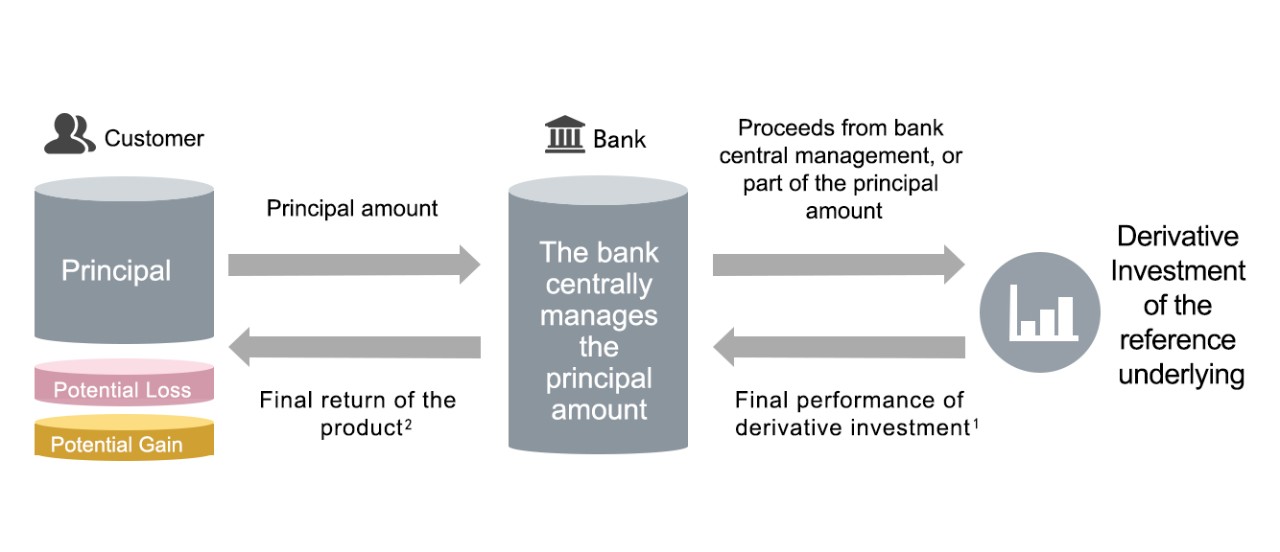

Structured deposits refer to deposits raised by commercial banks embedded in financial derivatives. The product is linked to financial assets such as interest rates, foreign exchange rates, indices or credit rating of an entity. By investing a small proportion of funds in the derivatives of specific underlying asset, it enables depositors to obtain relevant returns (if any) while taking certain risks.

Key benefits of HSBC structured deposits

- Access major global markets and a wide range of products

- Choose products tailored to your needs, in your preferred channel

HSBC structured deposits are linked to various financial assets across global markets including the US, Europe, and Asia. These include securities, ETFs, indices, and funds. By diversifying both in geography and in asset types, HSBC structured deposits allow investors balance risk and reward under various market conditions.

You can place an order via our branch, online banking or mobile banking*, or tailor your own product according to your own risk profile, market view and preference.

*To buy Feng Rui CNY Convertible Non-Principal Protected Structured Deposit, please see ELI page for more details.

Who are structured deposits suitable for?

- product with different risk levels apply to customers with different risk profiles

- customers who have knowledge of and/or experience in trading structured deposits

- customers who have their own views and interpretations of the market

SRBP - Strategic Retail Brokerage Platform

HSBC China is the first bank in industry that provides tailor-made solution for structured deposits. We have over 200 underlying assets, and 3 types of product structures for you to choose from - Asian Up and Out, EU Digital and Generic Growth. You can customise your product structure, underlying assets and product parameters based on your market view and preference.

Our SRBP has been recognised by the market since its launch, and was awarded the 'Best Technological Solution' by SPR China.

- broad market insights

- global coverage

- scenario analysis

- real-time quotes

More information about structured deposits

Investment channel

You can place your order through HSBC China Mobile Banking app, structured deposits online trading platform or visiting one of our branches.

Not an HSBC China customer?

If you are not an existing customer in HSBC China, you can apply for an account online, book an appointment or visit your nearest branch.

Open an account online

Make an appointment

Leave your contact details with us and we'll be in touch within 1-2 business days.

Call us

Please enter the country code for China +86 if you're calling from overseas, Hong Kong SAR, Macau SAR or Taiwan.