HSBC Greater Bay Area customer service hotline

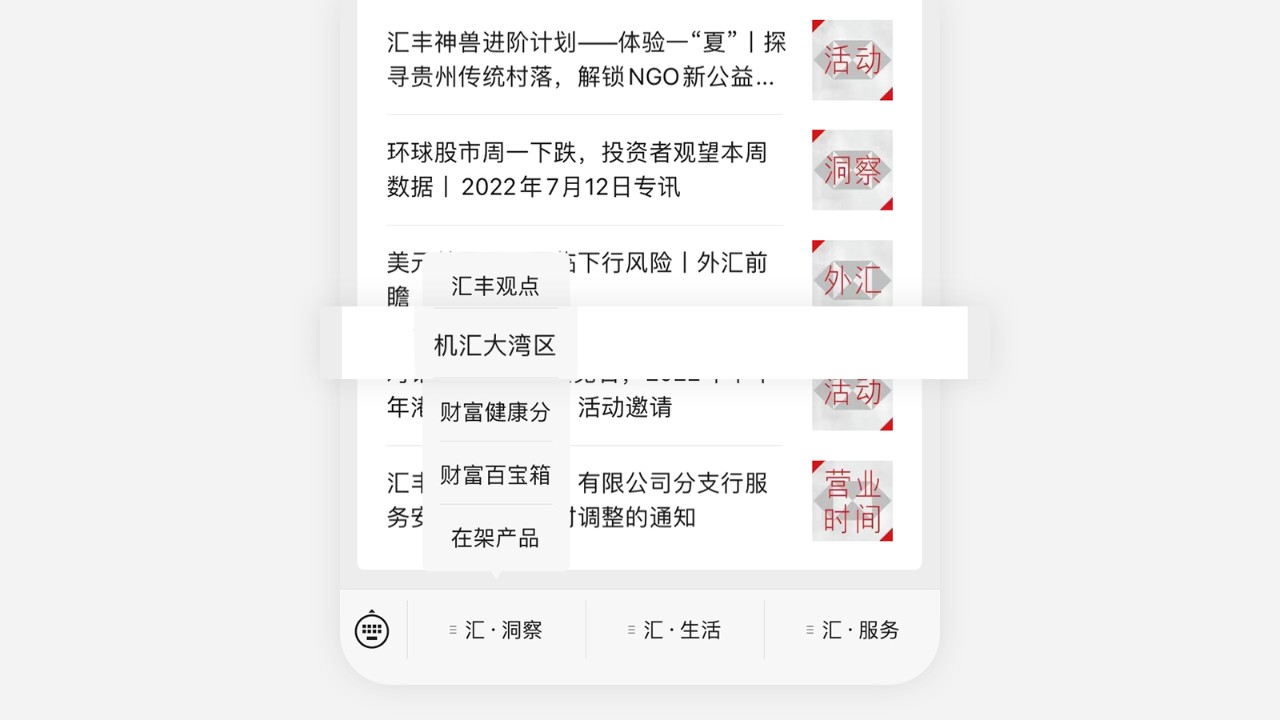

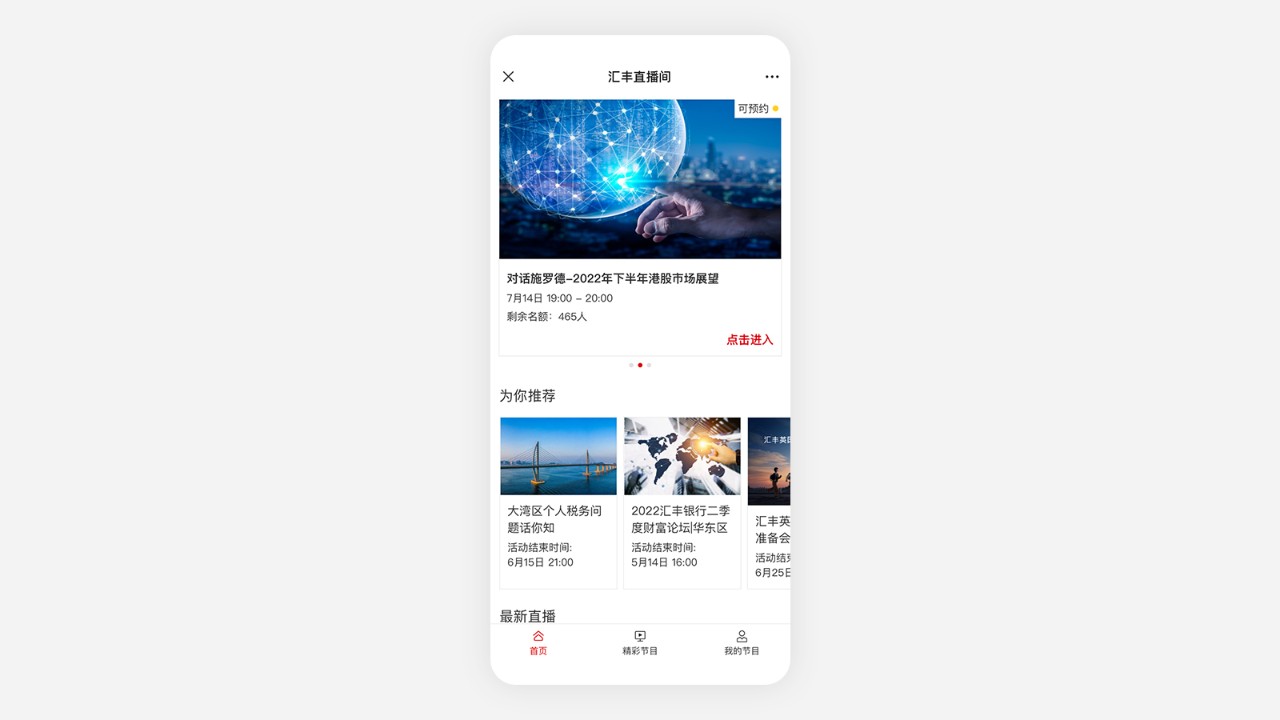

HSBC GBA Banking

Professional wealth solutions

Connected experience in the GBA and beyond

Simplified cross-border day to day banking

Exclusive privileges in the GBA

Become an HSBC customer

Make an appointment

Leave your contact details with us and we'll be in touch within 1–2 business days.

Call us or find a branch

HSBC Greater Bay Area Customer Service Hotline

400-920-3827 (24H, Mon - Sun)

If you are calling from overseas, Hong Kong SAR, Macau SAR or Taiwan, please use the country code for mainland China: +86

Learn more about HSBC Group in the GBA

HSBC HK is our partner bank in Hong Kong for GBA Wealth Connect. Learn more on HSBC HK website