Key benefits

- Choose how to transfer your money domesticallyGeneral, efficient, future-dated or recurring transfers are available based on your needs

- Transfer funds online and offlineMake domestic or cross-border transfers online or in our branch

- View all your accounts with one clickLog on to our online banking service, link and view all your global HSBC accounts

- Enjoy our services at a preferential rateMake a domestic RMB transfer online, free of charge

Note: Some of our systems will undergo maintenance on weekends and public holidays, and on weekdays from 21:30 to 8:00 (Beijing time). Your payment instructions – including outward remittances issued by us and inward remittances issued from other banks or us – may be delayed, depending on the situation. Please arrange your funds and transactions in advance as needed. We may also adjust our system maintenance time due to unforeseen circumstances, in which case we'll make an announcement in advance. Please refer to the 'Personal Banking - Important information - Maintenance' section on our official website. For enquiries, please contact your Relationship Manager or call our customer service hotline on 95366.

Please note that the date and time shown on your statements and the calculation of the interest will also depend on the daily cut-off time and the processing conditions of our different systems.

Contact us

Please leave your contact details and we'll be in touch in 1-2 business days.

Scan QR code to download HSBC China Mobile Banking APP

Domestic transfers

Make easy transfers and remittances with HSBC’s domestic inter- and intra-bank transfers, and transfer your funds in mere minutes. (During system maintenance, transactions may be affected temporarily.)

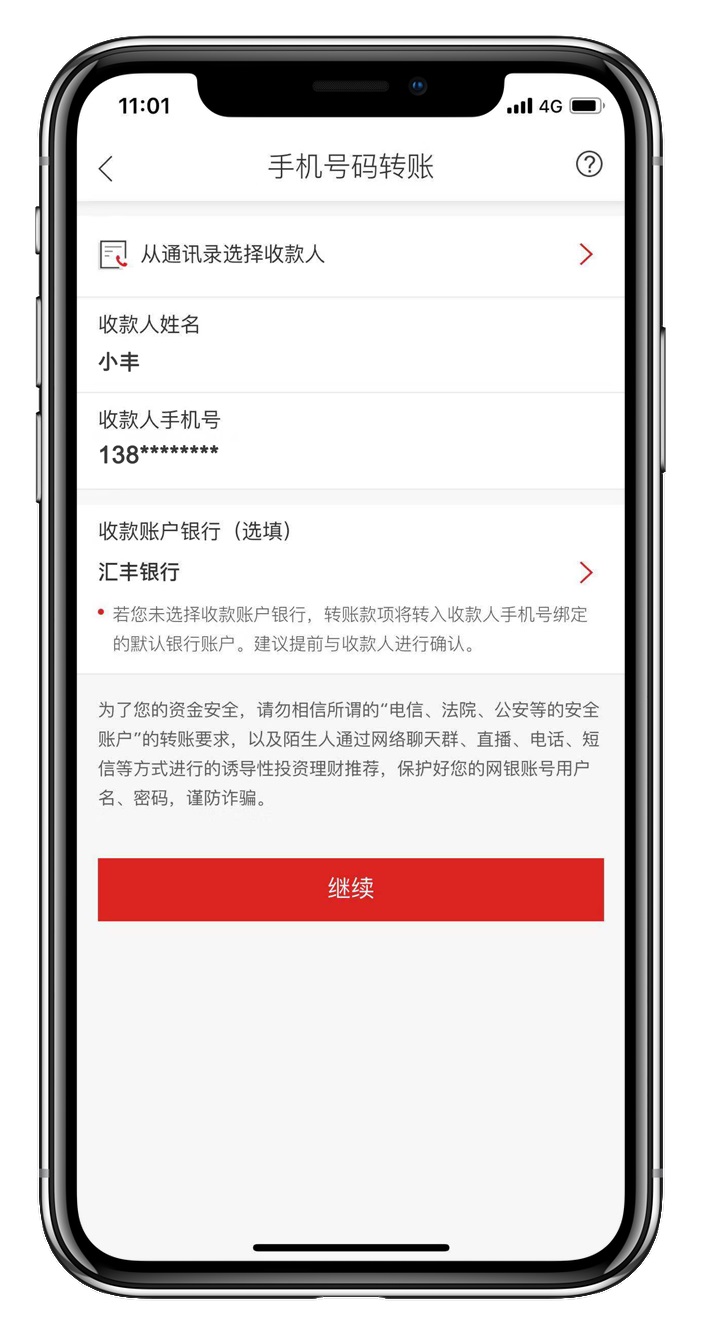

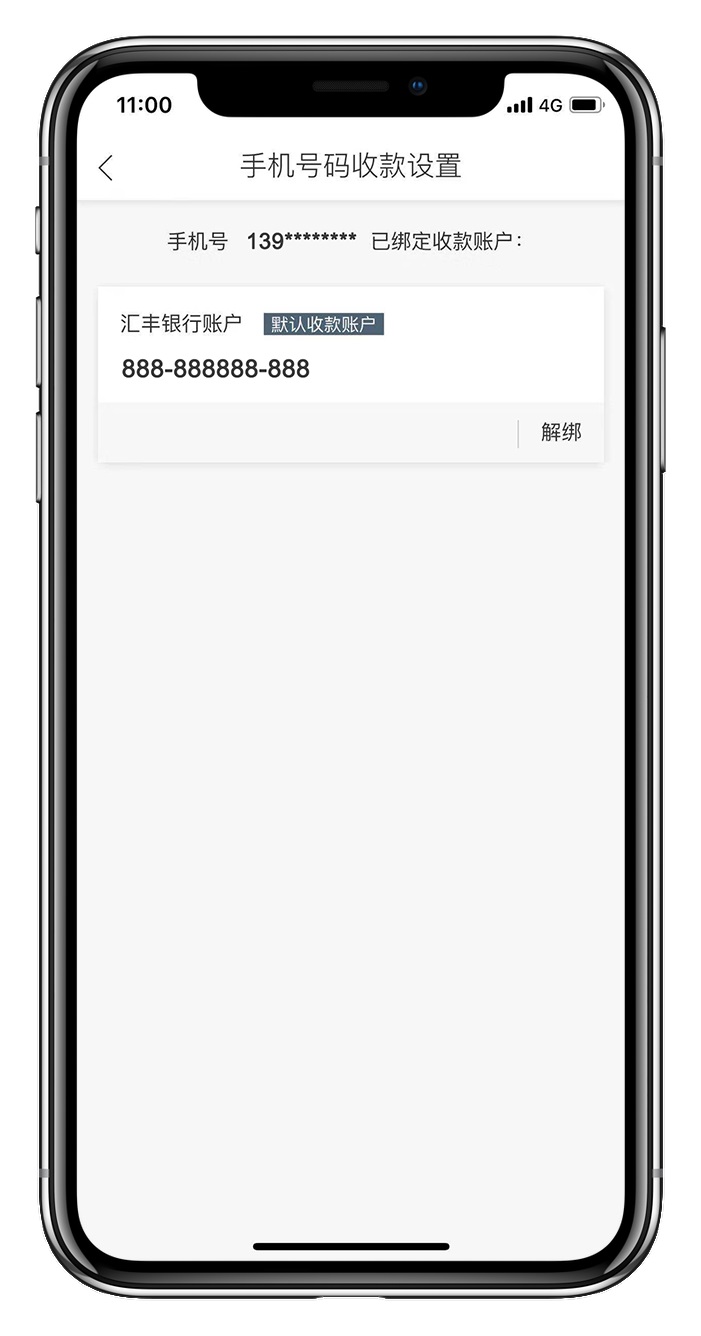

You can also make transfers to people using their mobile numbers if they have linked their bank accounts to their numbers. No more bank account details - just enter their names and phone numbers. It's that simple.

View how to transfer funds domestically

- You can make intra-city or inter-city CNY cross-bank payment via our electronic channels for free.

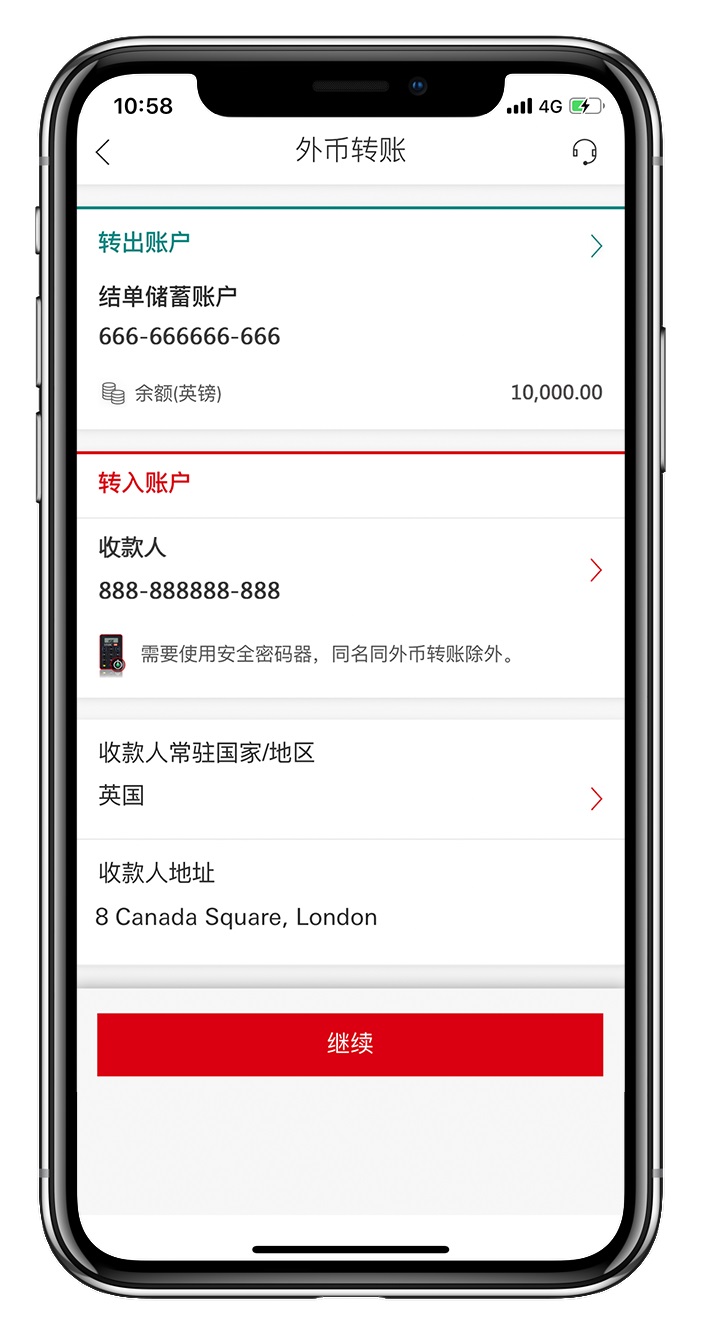

International transfers

Make flexible international transfers through various channels, including:

- HSBC International Education Payment System

Process FX purchase and FX remittance under overseas education category via HSBC China Mobile Banking after applicable online document check. - Global Transfer

Make quick cross-border foreign currency transfers to your or your family's account via online banking or mobile banking. Free for eligible* customers.

More on Global Transfer - Cross-border remittance

Global, secure and reliable. Simply the best.

*Note: Eligible customers include HSBC Premier, Premier Elite and Global Private Banking customers.

More details

Related Services

Deposit

Manage your wealth with ease. Choose from our range of products and services for savings accounts and time deposits.

Debit Cards

Bank conveniently with your Premier and Advance debit cards and pay no annual fees.

Foreign currency solutions

Fast and convenient foreign currency exchange services for when you're travelling, making payments or investing your money.

HSBC International Service

We support your dreams, whether it's meeting a financial goal, travelling, studying abroad, focussing on your career, or buying a new home. Our global experts are ready to help you.

Start banking with us

Make an appointment

Leave your contact details with us and we'll be in touch within 1-2 business days.

Call us

HSBC International Education Financial Services Hotline (For personal banking services only)

(24H, Mon - Sun)

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan