9 Jan 2024

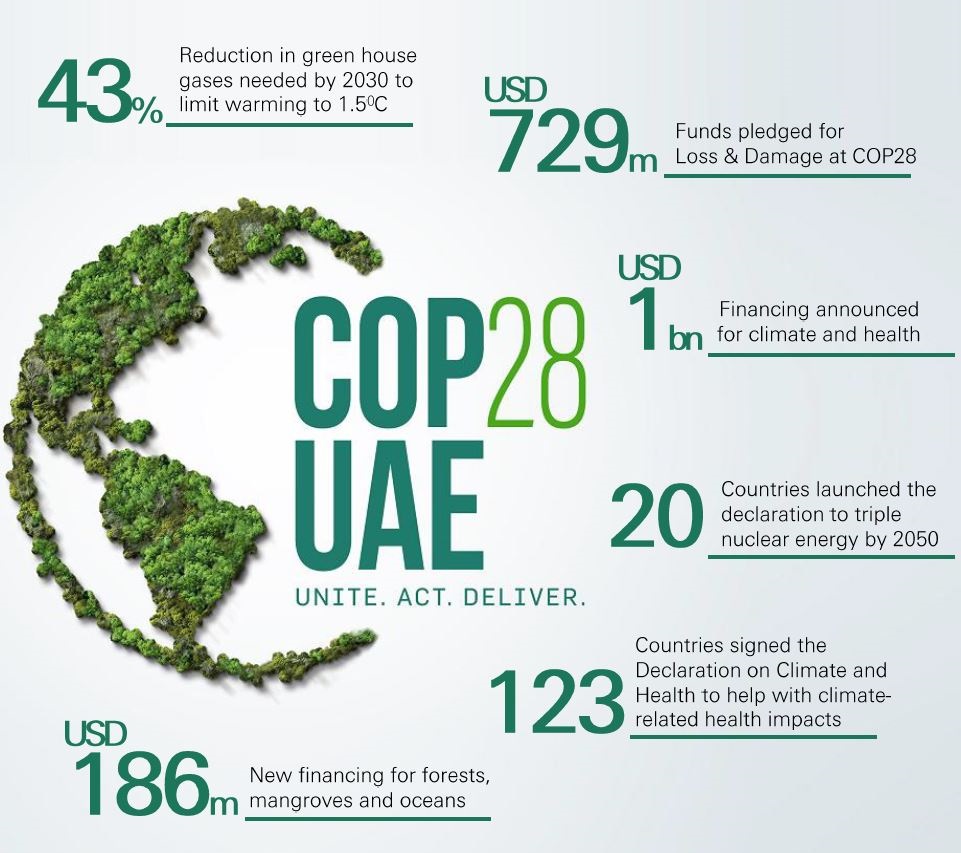

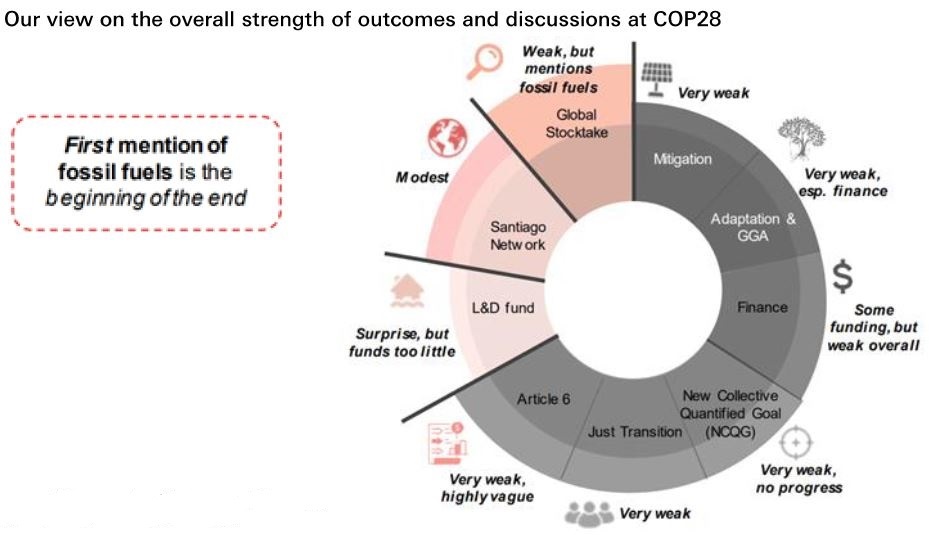

The transition away from fossil fuels was mentioned for the first time in a climate Conference of the Parties (COP) at last year’s summit held in Dubai (COP28). While the call to raise ambition of climate pledges fell short, several encouraging declarations on energy and food were made, which if implemented, could yield positive outcomes. Despite some minor wins, we think the overall progress of many issues was slow as most effort was focused on the stocktake, an assessment of how much progress countries have made towards the Paris Agreement targets.

In this issue of #WhyESGMatters, we discuss the progress towards climate targets at COP28, highlight the key issues agreed and what they mean for investors, and what lies ahead in the global climate discussions.

What is success?

COP28 overran significantly as all efforts focused on bridging the divergent views on fossil fuels. After a key win on day one from the operationalisation of the Loss & Damage Fund (a fund set up to pay developing countries for their climate-related loss and damages), discussions stalled on many key issues. If the success of COP28 is determined by whether fossil fuels were mentioned in the text, then there was some success. However, when evaluating the progress of various other climate issues, the outcomes were rather underwhelming.

The beginning of the end

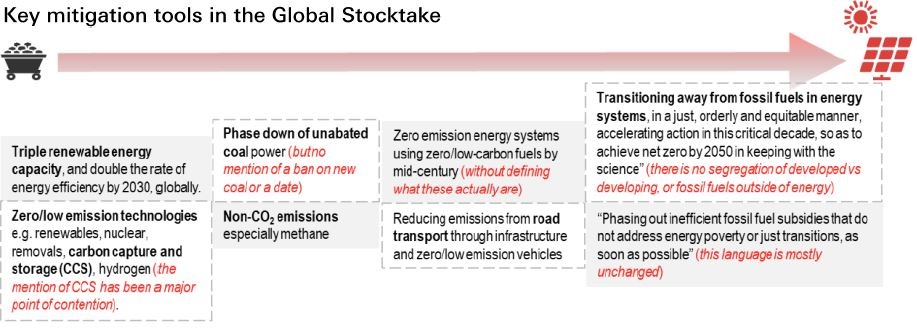

After five drafts and a 36-hour debate, the global stocktake settled on “Transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with the science”. This recognises fossil fuels as the main cause of climate change, yet gives fossil fuels companies leeway to determine how and when they will take part in this transition.

Lacking ambition

The progression in ambition of climate pledges (due early 2025) was not strong. Previous statements were merely repeated without calling for a significant rise in ambition. Adaptation took a backseat at COP28 with a lack of financial support and a weak outcome for the Global Goal on Adaptation (which aims to enhance the world’s adaptive capacity to climate change) that only seemed to set broad collective goals. The support for vulnerable countries was lacking, and many Parties were left disappointed that those most responsible for climate change don’t seemingly have to pay the consequences.

The key focus of this COP28 was on the Global Stocktake (GST) and the language pertaining to fossil fuels and their potential phase-out. There was an overwhelming sense of relief by many delegations that fossil fuels were mentioned. While this is an important decision, progress elsewhere was overshadowed, possibly overlooked in our view – by the push to get fossil fuels mentioned in the GST.

The first Global Stocktake of the Paris Agreement

The main debate revolved around the inclusion and implementation of a “fossil fuel phase-out/down” within the GST, with various options being considered throughout the fortnight. The GST recognises the need to reduce greenhouse gas emissions by 43% by 2030 and 60% by 2035 in order to limit warming to 1.5oC. However, it’s worth noting that there is no mention of a peak in emissions by 2025. The GST “calls on Parties to contribute to the following global efforts” by accelerating actions or using various tools, as shown below with our comments in red.

Finance

While there were various pledges to the Financial Mechanism, including Green Climate Fund, Global Environment Facility, Adaptation Fund, etc., not all of this finance is new and additional – with some subject to approval in domestic parliaments. In formal finance negotiations, discussions largely stalled, with little progress to take forward. Indeed, we’re still left with the same ask for developed Parties to fulfill the annual climate finance target of USD100bn to support developing Parties.

The Loss & Damage Fund

The Loss & Damage (L&D) Fund was swiftly passed on day one and will be designated as a Financial Mechanism of both the UN Framework Convention on Climate Change (UNFCCC) and the Paris Agreement.

There will be an annual “high-level dialogue” to review the effectiveness of the fund and discuss how it can be improved. The initial focus will be on “priority gaps within the current landscape of institutions” with further arrangements be approved at COP29 in 2024. Total pledged contribution as of the end of COP28 (according to the Presidency) is an estimated USD792m, although there is uncertainty as to ongoing commitment to the Fund. There were many comments from Parties that the funding is significantly short of what is required, although it’s a start.

Mitigation

The Mitigation Work Programme (MWP) progressed slowly, mainly because negotiators were awaiting the outcome of the GST. Many wanted to use the MWP to scale up ambition, but others just used it as a placeholder – not wanting new targets (at odds with the GST). The MWP is supposed to last until COP 31 in 2026; however but after two weeks of discussion, there was little progress, except a recalling of previous views and encouraging the submission of new views. For example, the final decision even removed the previous text of “highlights the importance of accelerating the just energy transition”.

Adaptation

Adaptation didn’t seem to get the attention that the most vulnerable Parties were looking for. Many delegates were not impressed with the report of the Adaptation Committee, stating that it didn’t engage enough with the science, while discussions didn’t really address the upcoming limits to adaptation (as per Intergovernmental Panel on Climate Change).

The discussion around the Global Goal on Adaptation (GGA), which was established to enhance adaptive capacity to climate change, progressed slowly. However, adaptation finance was recognised in the GGA, with certain important parts reaffirmed. Nevertheless, the request for “developed Parties to provide to developing Parties” was dropped from the final decision.

Article 6 of the Paris Agreement

Article 6 of the Paris Agreement recognises that some Parties choose to pursue voluntary cooperation in the implementation of their nationally determined contributions to allow for higher ambition in their mitigation and adaptation actions and to promote sustainable development and environmental integrity (as per UNFCCC). Overall, we consider the whole of Article 6 to have been weakened by discussions at COP28 with some Parties even calling for the whole moratorium on carbon markets within the Paris Agreement. Notably, no decision was taken on inclusion of emissions avoidance in the mechanism.

Implementation of all these initiatives is key. While the track record from previous COP summits hasn’t been great, these initiatives do add to peer pressure, ‘fear of missing out’ and bend the curve. Although they don’t go far enough, they are a starting point and we think the focus for all stakeholders – governments, businesses, financiers and investors as well as civil society – will be to ask for progress and hold signatories to account.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank (China) Company Limited, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA, HSBC FinTech Services (Shanghai) Company Limited and The Hongkong and Shanghai Banking Corporation Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements. HSBC specifically prohibits the redistribution of this material and is not responsible for any actions that third parties may take to and/or with it.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

Important information on ESG and sustainable investing

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.