3 Aug 2023

Ice cream is an increasingly popular treat around the world, but investors should be aware of sustainability issues ranging from climate change to labour conditions. While investors should take into account how ice cream is sourced, produced and sold, they should also consider that it doesn’t (and might not) last forever.

In this issue of #WhyESGMatters, we look at the key contributors towards ice cream’s environmental impact (raw materials, manufacturing and retail and packaging), and social issues associated with popular flavours (vanilla and chocolate) and marketing. We also consider how the ice cream sector is impacted by climate change.

Scooping it up

The ice cream industry is growing globally. According to Fortune Business Insights, ice cream market revenue could grow from cUSD74bn (2022) to USD105bn by 2029. Key drivers of this growth include rising demand for innovative flavours and increased consumption, especially in developing markets.[@ice-cream-1] We believe that this increased consumption could lead to greater stakeholder focus on sustainability aspects.

Before it melts

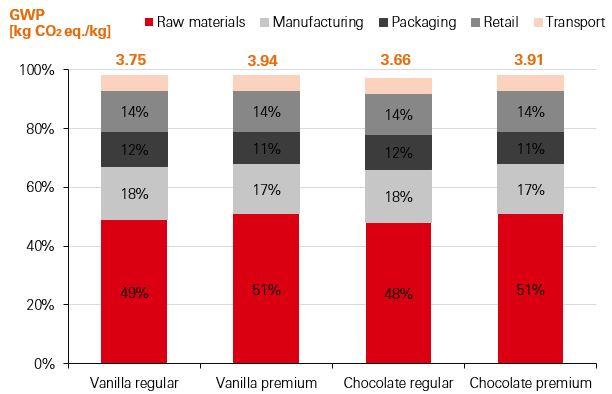

Ice cream has a significant climate impact, arguably higher than many other treats. For example, the emissions from producing 1kg of premium vanilla ice cream is 3.94 kg CO2 (see Figure 1), which is 1.8x the climate impact of producing the same quantity of cupcakes and 2.2x that of chocolate-coated biscuits.[@ice-cream-2] We believe this could lead to more scrutiny of retailers’ commitments to reducing the climate impact of ice cream, while also considering the social aspects of ice cream production.

Figure 1: Climate impact of ice cream

Dairy farming and the cultivation of other raw materials used for making ice cream are associated with a number of environmental impacts.

Impacts of milk:

Impacts of other raw materials (e.g. cocoa, vanilla):

Vanilla: While some mass-market producers now use artificial vanilla flavourings, real vanilla remains an ingredient in some ice creams, particularly high-end products. It’s the second-most expensive spice in the world (after saffron) due to its sophisticated and labour-consuming production process. The orchid that produces vanilla beans is pollinated by wild Melipona bees. Since there’re not many of these bees in other top vanilla-producing countries, each flower must be pollinated by hand.[@ice-cream-8]

Cocoa: According to the World Cocoa Foundation, c70% of cocoa is produced in West Africa, mostly Ghana and Côte d’Ivoire. Small- scale farmers are the beginning of complex, fragmented supply chains that often include harsh conditions. Limited access to water, sanitation, health and education services mean that many producers are below the poverty line.

Mislabelling and deceptive marketing: Due to growing competition, rising cost of ingredients and pressure to deliver differentiated products, numerous instances of mislabelling and misselling of ice cream have been reported across different geographies.

Manufacturing: The impacts are mostly attributable to energy consumption, particularly during the hardening process and deep freezing. Considering annual consumption of ice cream in the UK, the total primary energy demand contributes to 3.8% of energy consumption in the whole food sector. In our view, there’s an opportunity to reduce the energy intensity of the manufacturing stage by optimising energy use and increasing the use of low-carbon energy sources.

Packaging: Stakeholder attention to reducing the impacts of packaging, e.g. fossil fuel depletion, energy demand and waste management, is likely to increase. Polypropylene tubs, which are the most widely used packaging material for manufactured ice cream, are a notable hotspot for these impacts. Some brands are planning to introduce or have already introduced ice cream packaging made from a monolayer wrapper, paper-based materials, or fully biodegradable materials. We believe these moves will help reduce the percentage of plastic packaging ending up in landfills.

We believe that investors should also consider how the ice cream sector is impacted by climate change and how companies respond to these challenges. For example, rising temperatures can affect cow milk productivity; in hot climate conditions, cows tend to eat less, and this reduces the amount of milk they produce. Water shortages due to climate change are another significant challenge as dairy products are the third-largest food product category in terms of water footprint.[@ice-cream-12]

As global warming impacts production of ice cream ingredients, leading ice cream companies are taking measures to mitigate these risks. For example, according to the International Union for the Conservation of Nature, vanilla crops are facing the highest risk of extinction due to rising temperatures exacerbated by climate change.

Similarly, global cocoa production is threatened by climate change, as according to the International Centre for Tropical Agriculture, rising temperatures in the tropical equatorial countries may significantly impact the suitability of the main-producing countries for cocoa production over the coming years. To mitigate these risks, leading cocoa processing companies are diversifying their supply sources and developing sustainable agricultural practices.

Investors should continue to scrutinise companies’ commitments in the ice cream industry, in our view; with future improvements focusing on the raw materials stage, especially raw milk production, as well as vanilla and cocoa cultivation. Other areas of potential investor attention include energy reduction during the refrigeration stage, plugging refrigerant leaks, correct labelling of ingredients, honest marketing practices and social impacts on workers in supply chains. With investor input, we can help make ice cream more sustainably delicious over time.

1. This report is dated as at 6 July 2023 .

2. All market data included in this report are dated as at close 5 July 2023 , unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC’s analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC’s Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank (China) Company Limited, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA, HSBC FinTech Services (Shanghai) Company Limited and The Hongkong and Shanghai Banking Corporation Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements. HSBC specifically prohibits the redistribution of this material and is not responsible for any actions that third parties may take to and/or with it.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada, Australia or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

Important information on ESG and sustainable investing

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

© Copyright 2024. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.