15 Apr 2024

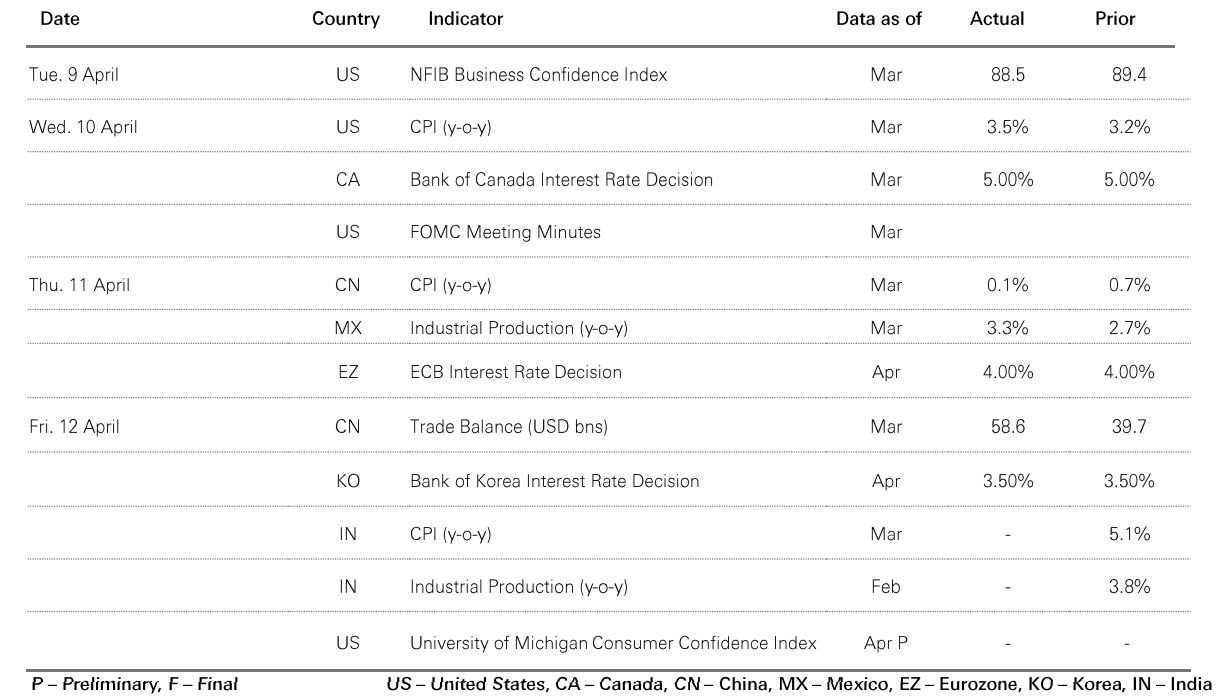

US Treasury yields have risen markedly since the start of the year, with the 10-year yield jumping above 4.5% last week for the first time since mid-November. Market repricing of 2024 Fed rate cuts has been a big driver of the move. This has come amid upside inflation surprises – including last week’s March CPI release showing broad-based stickiness in services inflation – and ongoing economic resilience, not least previous week’s bumper payrolls print. And it has revived the ‘higher-for-longer’ investor narrative that was such a key feature of market action last autumn.

Despite yields creeping higher, year-to-date gains across the risk asset universe have been impressive. But there are signs that risk markets are beginning to wobble under the strain of higher risk-free rates.

With valuations in pockets of the market looking stretched, a further leg up in bond yields could present a major challenge to risk asset pricing. High uncertainty regarding the level of the neutral interest rate means longer-dated yields lack a credible anchor. This makes them sensitive to cyclical developments, or movements in commodity prices.

Most worrying would be if yield moves are driven by sticky inflation or supply-side concerns in the oil market, rather than strong activity.

S&P 500 Q1 results season kicked off in earnest last week with big financials dominating the calendar early on. Full year 2024E consensus EPS growth stands at 10% overall, with profit growth of 3% in Q1 rising to 17.5% in Q4.

With the index on a hefty 21x price-earnings (PE) ratio, and rates still elevated, further significant multiple expansion looks challenging, with investors now demanding to see progress on earnings after a muted 2023.

Tech and communication services EPS growth remain at the top in Q1 (c. +20% y-o-y). Base effects are anticipated to boost Utilities. Five sectors are expected to decline including the cyclicals that rode the recent broadening-out rally, including Industrials, Energy and Materials as investors look beyond Q1. Any upside surprises here could support further market gains. In Financials, it looks more mixed with Banks weakest and Insurance strongest.

Analysts expect the costs of oil, shipping, transport and finance to fall back, even if wages are likely to remain a material headwind. Therefore, we will be closely monitoring outlook statements for signs that the expected H2 recovery in margins – baked into estimates – can materialise. Lastly, previous excitement over AI could also shift to more practical talk of near-term costs.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 12 April 2024.

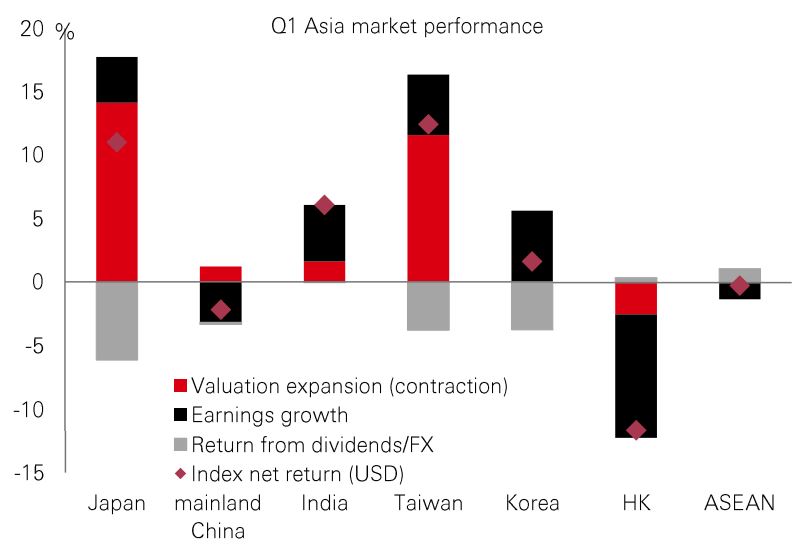

Asian stock markets enjoyed a good run in Q1. And although Japan was the regional outperformer, Asia ex Japan outperformed both LatAm and EMEA.

Amid the upswing in the semiconductor cycle, Taiwan notched up double-digit gains, beating Korea. But Korea's recently announced 'Value Up' programme — which aims to boost valuations and shareholder returns — will be a key area of investor focus.

Indian stocks extended last year's stellar run. By contrast ASEAN equities finished the quarter flat on a lacklustre growth outlook. But there are some interesting prospects within the bloc. The Philippines, for example, is gaining investor attention given cheap valuations, a healthy earnings outlook, and the prospects of big rate cuts by the central bank over the next year.

Perhaps the key move in 01 was in mainland China, where policy measures finally appear to have put a floor under prices.

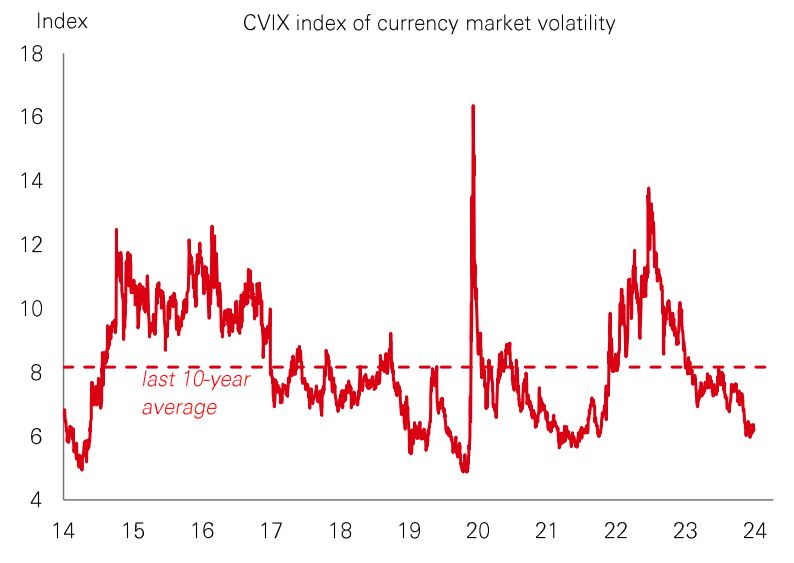

For a while now, currency market volatility has been very subdued. This echoes very low levels of implied equity market volatility as measured by the VIX index.

This may reflect growing investor confidence in the ‘soft landing’ narrative of resilient growth and disinflation across economies, and the idea that global central bank cutting cycles will be fairly synchronised.

The last week’s US CPI data throws this scenario into doubt. Mounting evidence of sticky US services inflation contrasts with better progress on disinflation in Europe and in many parts of the EM universe. This raises the possibility of growing policy divergence, even if anxieties about FX-driven inflation pressures constrain how much easing outside of the US can be introduced.

As the inflation path becomes bumpier and disinflation becomes more dependent on domestic rather than global factors, there is a good chance currency volatility reignites in the coming months.

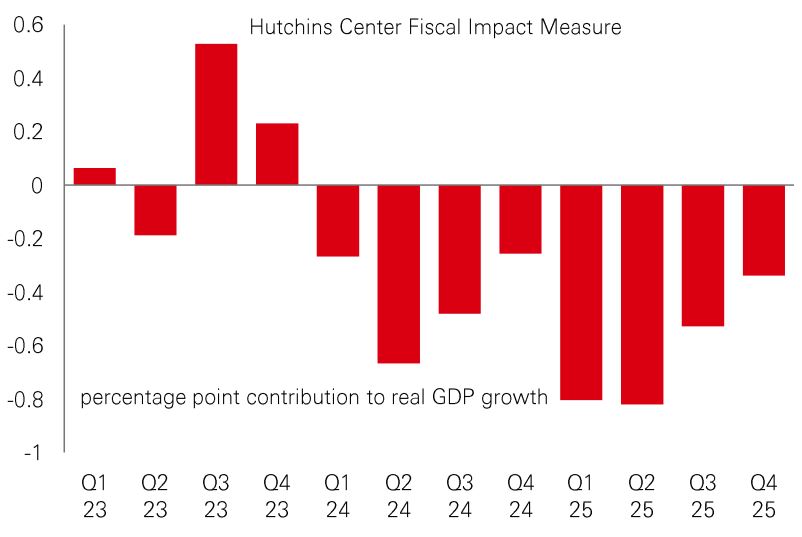

The strength of private sector balance sheets explains a big part of why the US economy has been so resilient to the fastest policy tightening cycle since the 1980s. But fiscal policy has also helped.

Last year, business investment saw a modest boost from government incentives under the CHIPS and Science Act and Inflation Reduction Act. There was also a rebound in direct spending by federal and state governments.

But 2024 will be different. Fiscal policy is expected to be contractionary; a drag on economic growth. Previous monetary policy tightening may bite with a lag. And ‘higher for longer’ interest rates may mean that policy-makers risk recession to defeat sticky inflation. This creates some future risks for GDP and profits growth, and stocks too.

The longer-term fiscal arithmetic will be impacted by the outcome of the US elections. And that will be an important event for investors. But the key point is that fiscal activism is back, and public deficits are likely to remain large. We’re not heading back to the 2010s, and that has major implications for investors.

Past performance does not predict future returns.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 12 April 2024.

Source: HSBC Asset Management. Data as at 11am UK time 12 April 2024.

Risk assets took a pause for breath after disappointing US inflation data, with core government bonds weakening amid a re-pricing of US rate expectations. US Treasuries underperformed Bunds as ECB President Lagarde suggested a eurozone rate cut was imminent, probably in June, with a “few members” calling for immediate policy easing. US equities were mixed, with the rate-sensitive Russell 2000 faring worst but large-cap technology stocks recovering some lost ground later in the last week. The Eurostoxx 50 index moved sideways whilst Japan’s Nikkei rebounded on a weaker yen. In emerging markets, China’s Shanghai Composite index fell, while India’s Sensex reached new highs before selling off later on the US inflation print. In commodities, ongoing geopolitical concerns are underpinning energy prices. Gold reached a new high.

WARNING: THE CONTENTS OF THIS DOCUMENT HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN THE PEOPLE’S REPUBLIC OF CHINA OR ANY OTHER JURISDICTION. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE INVESTMENT AND THIS DOCUMENT. IF YOU ARE IN DOUBT ABOUT ANY OF THE CONTENTS OF THIS DOCUMENT, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

This document has been issued by HSBC Bank (China) Company Limited (the “Bank”) in the conduct of its regulated business in China. It is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document must not be distributed to the United States, Canada or Australia or to any other jurisdiction where its distribution is unlawful. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings.

This document has no contractual value and is not and should not be construed as an offer or the solicitation of an offer or a recommendation for the purchase or sale of any investment [in any jurisdiction in which such an offer is not lawful] or subscribe for, or to participate in, any services. The Bank is not recommending or soliciting any action based on it.

The information stated and/or opinion(s) expressed in this document are provided by HSBC Bank (China) Company Limited. We do not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at any time without notice. They are expressed solely as general market information and/or commentary for general information purposes only and do not constitute investment advice or recommendation to buy or sell investments or guarantee of returns. Do not rely on it for any investment or financial decisions.

The Bank and HSBC Group and/or their officers, directors and employees may have positions in any securities or financial instruments mentioned in this document (or in any related investments) (if any) and may from time to time add to or dispose of any such securities or financial instruments or investments. The Bank and its affiliates may act as market maker or have assumed an underwriting commitment in the securities or financial instruments discussed in this document (or in related investments) (if any), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those companies.

The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. You should carefully consider whether any investment views and investment products are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. The investment decision is yours but you should not invest in any product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. The relevant product offering documents should be read for further details.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Such statements do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We can give no assurance that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. We do not undertake any obligation to update the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investment involves risk. It is important to note that the capital value of investments and the income from them may go down as well as up and may become valueless and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Past performance information may be out of date. For up-to-date information, please contact your Relationship Manager.

Investment in any market may be extremely volatile and subject to sudden fluctuations of varying magnitude due to a wide range of direct and indirect influences. Such characteristics can lead to considerable losses being incurred by those exposed to such markets. If an investment is withdrawn or terminated early, it may not return the full amount invested. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in certain jurisdictions. Narrowly focused investments and smaller companies typically exhibit higher volatility. There is no guarantee of positive trading performance. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Investment schemes are subject to market risks. You should read all scheme related documents carefully.

Copyright © HSBC Bank (China) Company Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Bank (China) Company Limited