25 February 2025

Investments can go up and down. Over the long term, however, they tend to go up, so you’re more likely to see returns from a longer than a shorter-term investment.

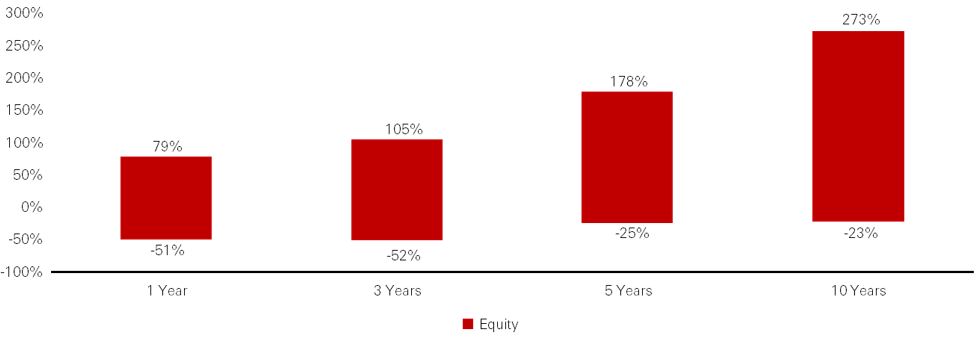

The chart shows the performance of global equities over different time frames between 1999 and 2024.

For example, the left bar shows that the performance of global equities over any 1-year period between 1999 and 2024 ranged between -51% and 79%. For any 10-year period, the returns ranged between -23% and 273%.

Chart: Performance of global equities

Currency: USD. Source: Bloomberg, HSBC Asset Management, as at 31 December 2024. Indices used: Equities – MSCI AC World Total Return Index. Bonds – Bloomberg Global-Aggregate Total Return Index Value Unhedged USD. 'Diversified’ is a representative, balanced asset allocation across global equities, bonds and alternatives. Bond indices are hedged. Equities are unhedged. Past performance is no guarantee of future returns.

Firstly, set your investment goals. Want to save for a dream wedding or a deposit on a house in 3 years? Or save up to have a family in 10 years? The longer you plan to invest for, the more risk you can take. That’s because you have more room to make riskier investments as the market has a chance to recover from any sharp falls in value.

Lastly, think about which investment types might be suitable - the table below shows some of the options for the different timeframes.

| Investment horizon | Duration | Risk level

|

Investment options |

| Short term | 3-6 months

|

Low | High-yield saving accounts

Money market accounts

Short-term bond mutual funds

Certificates of deposit

Government bonds

Money market mutual funds |

Medium term |

>12 months | Medium | Structured products

Single stocks / bonds

Mutual funds |

| Long term | Over 10 years | High | Single stocks / bonds

Mutual funds |

| Investment horizon | Short term | Short term |

|---|---|---|

| Duration |

3-6 months

|

3-6 months

|

Risk level

|

Low | Low |

Investment options |

High-yield saving accounts

Money market accounts

Short-term bond mutual funds

Certificates of deposit

Government bonds

Money market mutual funds |

High-yield saving accounts

Money market accounts

Short-term bond mutual funds

Certificates of deposit

Government bonds

Money market mutual funds |

| Investment horizon |

Medium term |

Medium term |

| Duration | >12 months | >12 months |

Risk level

|

Medium | Medium |

Investment options |

Structured products

Single stocks / bonds

Mutual funds |

Structured products

Single stocks / bonds

Mutual funds |

| Investment horizon | Long term | Long term |

| Duration | Over 10 years | Over 10 years |

Risk level

|

High | High |

Investment options |

Single stocks / bonds

Mutual funds |

Single stocks / bonds

Mutual funds |

The phrase ‘don’t put all your eggs in one basket’ is as true for investing as in the supermarket! Investing in a diverse mix of assets means you’re more insulated from any drops in value. Over time, a well-diversified portfolio of stocks, bonds and other assets has proved itself a winning strategy.

Once you’ve started making a return on your investment, it’s worth thinking about reinvesting your dividends, and harnessing the power of compound interest. All this means is earning interest on your interest. Over time, your money’s rate of growth will accelerate, so time is your ally. The longer you can leave it, the greater the effect.

Don't just chase that hot investment idea you’ve heard about. Always do your own analysis on a company before investing your hard-earned money. Regardless of the source, never accept a stock tip as valid. And stick to the investment horizon principles above when assessing how much risk to take. Rather than panic over short-term movements, it’s better to track your portfolio’s big-picture trajectory.

It’s important to differentiate 'real losers' from 'bad performers'. Stocks that do well over time but which have had a bad week – or even a bad year – are probably worth holding onto. If a stock looks like it’s on a long-term downward trajectory, it could be time to cut your losses and move on.

A long-term investment strategy doesn’t have to mean picking a fund and then doing nothing with it. Although ‘passive' investing can be a good strategy for many people, ‘active’ investing means taking investment opportunities and adjusting your strategy for long-term growth.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank Canada, HSBC Bank (China) Company Limited, HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (127776-V) / HSBC Amanah Malaysia Berhad (807705-X), The Hongkong and Shanghai Banking Corporation Limited, India, HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful. The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/ business. However, the Bank disclaims any guarantee on the management or operation performance of the trust business.

© Copyright 2023. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.