29 December 2025

After a slow start to the year, global climate stocks – particularly in the solar, wind and nuclear sectors – have made a strong comeback, outperforming global equities year-to-date. Looking forward, HSBC Global Investment Research identifies solar and energy storage as the compelling opportunities within the climate change space. Solar energy continues to lead the global clean energy transition, supported by falling costs, favourable policy frameworks, and rapid technological progress. Meanwhile, energy storage is becoming increasingly critical for reducing emissions across both the transport and power industries.

Sources: IEA – Global Energy Review 2025 – License: CC by 4.0; HSBC Global Investment Research

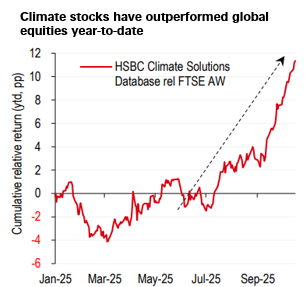

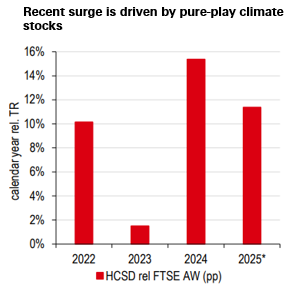

Global climate stocks in the HSBC Global Investment Research (HSBC Research) proprietary HSBC Climate Solutions Database[@why-esg-matters-04-01] (HCSD) saw a strong price performance in the third quarter of this year and have outperformed the global equity benchmark (FTSE All World Index) by 11.4 percentage points[@why-esg-matters-04-02] in 2025, as of 16 October. This follows the steady outperformance of climate stocks over the past few years, including a 15.4 percentage point gain in 2024.

HSBC Research’s analysis of climate stocks by region and sector suggests that the recent price outperformance is broad-based, marking a notable turnaround from the challenging outlook earlier in the year. Political backlash, deteriorating sentiment attached to sustainable investing, and concerns associated with greenwashing and regulatory changes had an adverse impact on the performance of climate stocks in the HCSD in the first few months of 2025.

While many of these issues persist, the strong relative performance of climate stocks since early July aligns with a slight reduction in uncertainty, particularly related to the US climate policy, partly alleviated by the One Big Beautiful Bill.

Drilling down further, pure-play climate stocks – those generating more than half of their revenues from climate-related activities, have delivered the strongest returns this year, approximately around 35%. This likely reflects investors’ preference for pure-play stocks, while expanding their exposure to the universe of clean-tech companies.

Importantly, companies with less than 50% climate revenue exposure have also outperformed the global equity benchmark in 2025. This ongoing trend reinforces the consistent outperformance of climate stocks over the past decade, despite facing various market challenges.

Analysis of regional price performance of stocks in the HCSD shows Asia-Pacific leading with a 34% year-to-date return. While climate stocks in North America and Europe have lagged HCSD stocks in aggregate, they have still outperformed the global equity benchmark.

Historically, Asia-Pacific climate stocks have delivered stronger returns than other regions, driven by a robust economic growth and increased investment in clean technologies. Notably, the region represents over half of all climate stocks in the HCSD and remains a significant contributor to global climate company revenues.

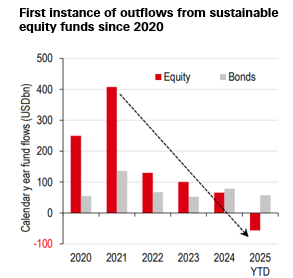

Sustainable equity funds[@why-esg-matters-04-3] have experienced net outflows of USD 57 billion year-to-date—the first recorded outflows since 2020. The US market is the primary contributor, accounting for USD 43.5 billion of these outflows as of 10 October this year. This trend is largely attributed to political backlash, waning investor sentiment towards sustainable investing, and concerns over greenwashing and regulatory changes.

In contrast, sustainable bond funds have maintained strong momentum in 2025, attracting USD 57 billion in inflows, representing over 6% of all global bond fund inflows.

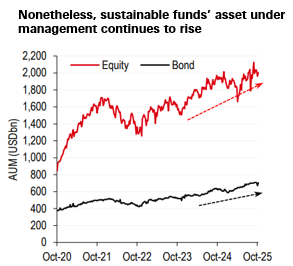

Despite the outflows from equity sustainable funds, assets under management (AUM) for both equity and bond sustainable funds have increased, reflecting robust price performance and supporting observations of strong returns in global climate stocks[@why-esg-matters-04-04]. Notably, since 2021, the long-term growth in AUM for sustainable equity and bond funds has been higher than all-equity and all-bond funds, respectively.

Across major markets, the US remains a significant drag, with year-to-date outflows intensifying in recent months—rising from approximately USD 16 billion at the end of the last quarter to around USD 43 billion currently across both equity and bond sustainable funds. These outflows, exceeding 10% of AUM in both categories, highlight a deteriorating outlook for sustainable investments in the US. The early termination and phase-down of Inflation Reduction Act tax credits for renewables and transport, as legislated in the One Big Beautiful Bill, have further dampened sentiment.

While US outflows dominate, there is evidence of rotation into Europe and Asia, with Switzerland and mainland China reporting net inflows.

HSBC Research applied their quantitative framework to the HCSD, identifying solar and energy storage as the most attractive themes within their climate change space. We examine the underlying fundamentals supporting these sectors.

Solar energy continues to lead global clean-energy growth, supported by falling costs, strong policies and rapid technology gains. Investments in solar photovoltaic technology (cells that convert sunlight into electricity) are expected to surpass USD450bn in 2025, outpacing all other renewable energy sources, according to IEA World Energy Investment[@why-esg-matters-04-05] 2025 estimates.

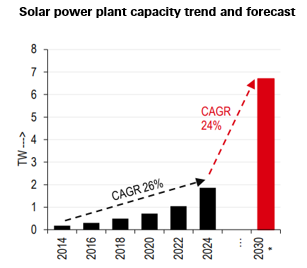

Global renewable energy pledges and policies are driving the growth of renewables and solar power. These include plans to triple renewable energy generation capacity to at least 11TW by 2030 (COP28); end a reliance on fossil fuels (REPowerEU); mobilize USD1trn in solar energy investments by 2030 (International Solar Alliance), and numerous supportive national policies and targets set by countries such as China, India, UAE, South Africa and Brazil. Furthermore, to align with the IEA[@why-esg-matters-04-06] net-zero scenario, solar generation needs to reach approximately 9,200TWh by 2030, requiring an annual average growth rate of around 28% from 2024 levels.

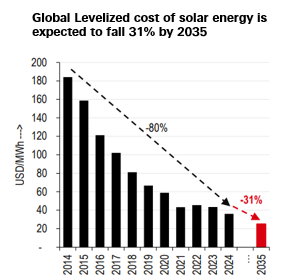

Advanced manufacturing capabilities, a reduction in polysilicon prices, and growing economies of scale have resulted in the significant fall in solar cell prices over the last decade, making them more competitive relative to fossil-fuels powered energy generation. The cost of solar energy has become substantially lower than both gas, coal, and other renewable energy sources except wind. Moreover, the BNEF expects the cost to fall further by 31% over the next decade, potentially making it an attractive long-term energy investment.

Emerging economies are forecasted to add c78% of the global net solar capacity additions by 2030, which is principally driven by China. Indeed, China has emerged as a global centre for the solar energy investment and supply chain, with the country adding almost two-thirds of all new renewable capacity globally in 2024.

Reducing emissions from the transport and power sectors, which together represent approximately two-thirds of global emissions, is key to hitting net-zero goals. Energy storage systems play a pivotal role in improving the efficiency and reliability of clean transport and renewable power sources. According to the IEA’s net-zero emissions scenario for 2050, increased adoption of electric vehicles could reduce oil demand by 8 million barrels per day by 2030, with battery solutions being central to this transition.

In the electricity sector, battery storage solutions enhance the efficiency of power systems by storing excess energy during periods of low demand and releasing it when demand is high. This minimises losses and supports the integration of renewables into the grid.

To align with the IEA’s net-zero scenario, global annual demand for energy storage batteries must increase sixfold to reach 6TWh by 2030. Of this demand, 90% is projected to come from batteries for electric and hybrid vehicles, with the remaining 10% from other energy storage applications. Additionally, the global energy battery systems market is expected to quadruple, reaching USD 500 billion by 2030, up from USD 120 billion in 2023.

The clean transport and energy sectors now account for over 90% of global annual demand for lithium-ion batteries—a figure set to rise as falling battery prices drive broader adoption of electric vehicles, as well as utility-scale and residential solar solutions. Battery costs have dropped significantly, from USD 1,400/KWh in 2010 to below USD 115/KWh in 2024. Continued innovation and higher-density battery production are expected to reduce average global prices to under USD 100/KWh within the next few years, further supporting the energy transition.

Clean energy sectors—particularly solar, wind, and nuclear—have underpinned strong performance in climate-related equities in 2025. At the same time, outflows from US sustainable equity funds have increased, with Switzerland and China emerging as leading recipients. Analysis from HSBC Research highlights solar and energy storage as the most promising themes within the climate change investment landscape.

1. This report is dated as at 10 December 2025.

2. All market data included in this report are dated as at close 9 December 2025, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC’s analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC’s Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank (China) Company Limited, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA, HSBC FinTech Services (Shanghai) Company Limited and The Hongkong and Shanghai Banking Corporation Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements. HSBC specifically prohibits the redistribution of this material and is not responsible for any actions that third parties may take to and/or with it.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”): HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India does not distribute or refer investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or any other jurisdiction where such distribution or referral would be contrary to law or regulation.

HSBC India is an AMFI-registered Mutual Fund Distributor of select mutual funds and a referrer of other 3rd party investment products. HSBC India will receive commission from HSBC Asset Management (India) Private Limited, in its capacity as a AMFI registered mutual fund distributor of HSBC Mutual Fund. The Sponsor of HSBC Mutual Fund is HSBC Securities and Capital Markets (India) Private Limited (HSCI), a member of the HSBC Group. Please note that HSBC India and the Sponsor being part of the HSBC Group, may give rise to real, perceived, or potential conflicts of interest. HSBC India has a policy in place to identify, prevent and manage such conflict of interest. For more information related to investments in the securities market, please visit the SEBI Investor Website: https://investor.sebi.gov.in/ and the SEBI Saa₹thi Mobile App. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Issued by The Hongkong and Shanghai Banking Corporation Limited India.

Important information on ESG and sustainable investing

In broad terms “ESG and sustainable investing” products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as sustainable may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t consider these factors. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future. Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document or video may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.