12 June 2025

Artificial intelligence (AI) offers many positives to help speed up the transition to a net zero world. Our main questions are whether it will speed up or slow down emissions control, whether it can help channel capital for low-carbon financing, and how it can help monitor and predict the consequences of warmer temperatures. As we discuss in this report, on balance, we think the growth of AI is a positive for net zero delivery and provides governments with a toolkit to progress net zero ambitions.

Source: de Vries, Alex, The growing energy footprint of artificial intelligence, Joule, 18 October 2023; Powering Intelligence: Analysing Artificial Intelligence and Data Centre Energy Consumption, May 2024; ‘Next-Gen Wind Farms: Dell’Oro Group, 2025; Wind Turbine Optimisation with AI’, Datategy, 17 January 2024

AI is experiencing unprecedented traction and is reshaping various industries. It’s enabling smart decision-making by leveraging advances in machine learning, natural language processing and generative modelling. There are several ways in which the growth of AI has read-across for the speed of delivering a net zero economy.

1. Emissions control

The increasing adoption and sophistication of AI models are leading to greater power demand and in turn, impacting emissions levels. Indeed, carbon emissions for the training of more recent AI models have increased significantly, with GPT-3 (released in 2020) emitting 588 tons, GPT-4 (2023) emitting 5,184 tons, and Llama 3.1 405B emitting (2024) 8,930 tons.[@why-esg-matters-02-01]

On the positive side, AI can help drive the energy transition if new data centres are in places where clean power is already used or can be scaled up. Alternatively, above-forecast power consumption from data centres in areas with more carbon intensive fuel sources (e.g. coal) will likely add more CO2 than expected from business-as-usual pathway assumptions.

Current AI trends would likely add to the emissions picture, given that fossil fuels account for 60% of the global power mix, although this hides the locational aspect of data centres. If the power sector decarbonises faster than the energy demands of advanced AI, this would be a win for the net zero transition. Separately, AI monitoring tools can help manage emissions in the land-use change and forestry sectors, which is a positive for a net zero outcome.

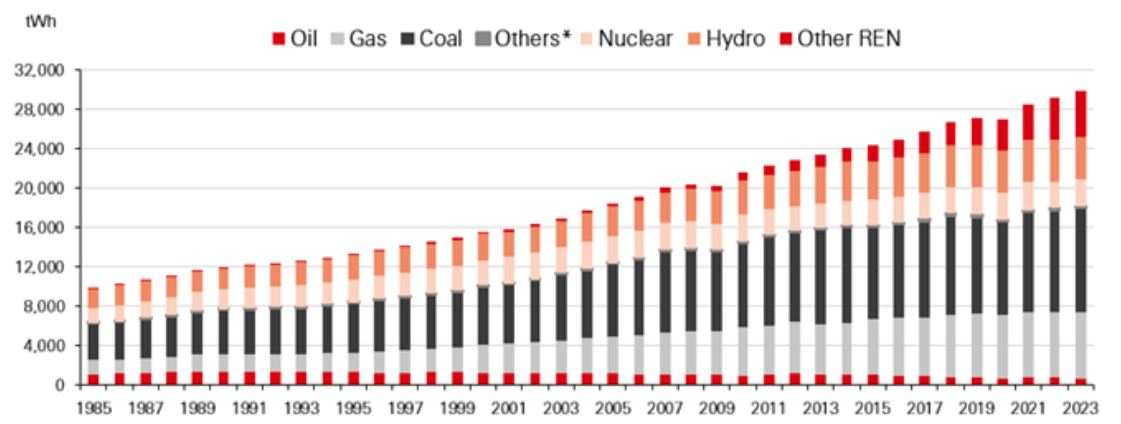

Power use is up 28% in the last 10 years; renewables are growing in share

In terms of renewables, AI can help reduce emissions by optimising energy integration, storage, distribution and forecasting production. A significant problem faced by the adoption of renewable energy is intermittency; integrating AI helps manage fluctuations, ensuring a stable and reliable supply. Predictive maintenance also helps reduce downtime and repair costs.

2. Financing a net zero future

The Independent High-Level Expert Group on Climate Finance estimates that, by 2030, between USD6.3trn and USD 6.7trn per year will be needed globally to meet climate goals[@why-esg-matters-02-02]. This includes substantial investments in the clean energy sector, loss and damage, natural capital and just transition. We think there’re three channels through which the growth of AI can help fund the energy transition:

i. Catalysing renewable energy investment: Increased interest in data centre hub locations could spark further grid investment and more efficient processes for streamlining projects. Ireland, for example, recently injected EUR750m into developing its electricity grid to cater to increased AI demand.[@why-esg-matters-02-03]

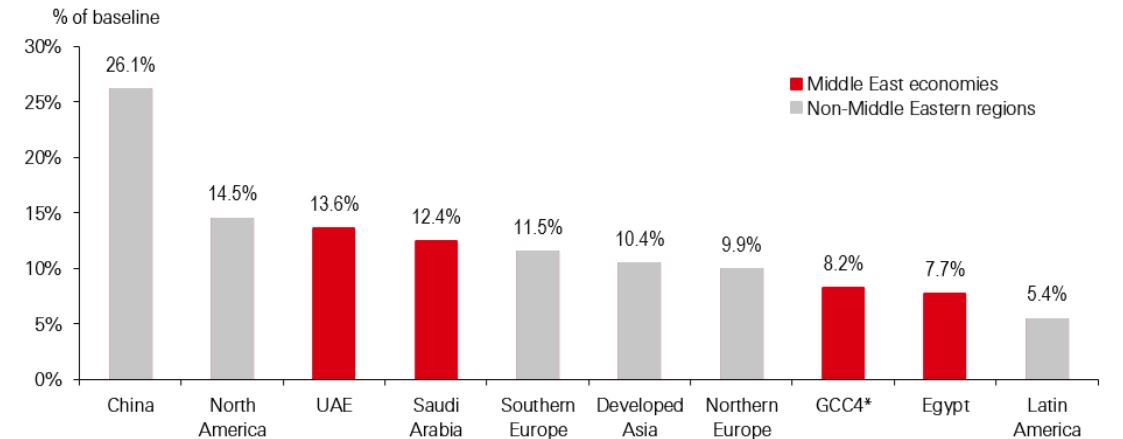

ii. Contributing to GDP: Funding for the low-carbon transition will come from a variety of sources, including country public finances and sovereign wealth funds. As AI grows as a sector, it becomes an increasingly important contributor to GDP. PwC estimates that AI could contribute up to USD15.7trn to the global economy by 2030[@why-esg-matters-02-04].

iii. Improving access to capital: AI technology can help attract investment into nature-based solutions by providing more robust analysis of projects, such as improving data accuracy, monitoring carbon footprints and optimising project selection, which ensures investments are directed toward impactful initiatives.

By 2030, contribution of AI to GDP by region

3. Building resilience to disruptive impacts

Inclusive resilience relates to productivity, both in terms of people’s ability to find roles in transition sectors and human activities linked to productivity in their jobs. Additionally, within a country, the levels of social equity impact its ability and willingness to transition. We believe AI can be a powerful tool for managing environmental impacts, alongside enhancing economic productivity.

Applications include monitoring and predicting extreme weather events, managing biodiversity conservation, addressing food loss and waste challenges and providing optimal utilisation of resources. This enables labour productivity by minimising work-hour loss due to unforeseen circumstances, such as road closures from flooding that delay employees from getting to and from work.

We think a lack of data on the precise scale of AI’s environmental impacts hinders policymakers’ and investors’ ability to fully assess risks. Current regulatory initiatives on data centres focus on optimising energy efficiency and mainly set minimum targets or guidelines for firms. Indeed, the European Commission requires data centre operators to report annually on energy and water use, waste heat reuse and renewable energy consumption.

In our view, enhanced disclosure requirements and assessment frameworks across AI supply chains are needed to bring more clarity to investors, governments and other stakeholders. The following aspects should be considered:

As some markets are currently developing or looking to implement mandatory reporting requirements for climate-related disclosures in line with the International Sustainability Standards Board’s standards, we think there’s an opportunity for policymakers to determine how these reporting requirements should be applied by AI developers and users, data centre operators and hardware manufacturers.

How emissions are controlled is relevant to investors because country plans and economic rationale define climate goals, which impact the energy system and connect to economic activity. AI is relevant in this context because the increased adoption and sophistication of AI models lead to increased power demand, in turn impacting emissions levels.

The emissions associated with energy used and the use cases for process optimisation, help in catalysing funding for the transition, and using the technology for monitoring, policing and predicting disruption to livelihoods are all relevant. Taking all these influences into account, we think the growth of AI is beneficial for delivering and managing net zero positive outcomes.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Bank (China) Company Limited, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA, HSBC FinTech Services (Shanghai) Company Limited and The Hongkong and Shanghai Banking Corporation Limited and HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

The following statement is only applicable to HSBC Mexico, S.A. Multiple Banking Institution HSBC Financial Group with regard to how the publication is distributed to its customers: This publication is distributed by Wealth Insights of HSBC México, and its objective is for informational purposes only and should not be interpreted as an offer or invitation to buy or sell any security related to financial instruments, investments or other financial product. This communication is not intended to contain an exhaustive description of the considerations that may be important in making a decision to make any change and/or modification to any product, and what is contained or reflected in this report does not constitute, and is not intended to constitute, nor should it be construed as advice, investment advice or a recommendation, offer or solicitation to buy or sell any service, product, security, merchandise, currency or any other asset.

Receiving parties should not consider this document as a substitute for their own judgment. The past performance of the securities or financial instruments mentioned herein is not necessarily indicative of future results. All information, as well as prices indicated, are subject to change without prior notice; Wealth Insights of HSBC Mexico is not obliged to update or keep it current or to give any notification in the event that the information presented here undergoes any update or change. The securities and investment products described herein may not be suitable for sale in all jurisdictions or may not be suitable for some categories of investors.

The information contained in this communication is derived from a variety of sources deemed reliable; however, its accuracy or completeness cannot be guaranteed. HSBC México will not be responsible for any loss or damage of any kind that may arise from transmission errors, inaccuracies, omissions, changes in market factors or conditions, or any other circumstance beyond the control of HSBC. Different HSBC legal entities may carry out distribution of Wealth Insights internationally in accordance with local regulatory requirements. HSBC specifically prohibits the redistribution of this material and is not responsible for any actions that third parties may take to and/or with it.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

Important information about ESG and Sustainable Investing

In broad terms "ESG and sustainable investing" products include investment approaches or instruments which consider environmental, social, governance and/or other sustainability factors to varying degrees. Certain instruments we classify as ESG or sustainable investing products may be in the process of changing to deliver sustainability outcomes. There is no guarantee that ESG and Sustainable investing products will produce returns similar to those which don’t have any ESG or sustainable characteristics. ESG and Sustainable investing products may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for, ESG and Sustainable investing or the impact of ESG and Sustainable investing products. ESG and Sustainable investing and related impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the ESG / sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of ESG / sustainability impact will be achieved. ESG and Sustainable investing is an evolving area and new regulations and coverage are being developed which will affect how investments can be categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.

When we allocate an HSBC ESG and Sustainable Investing (SI) classification: HSBC ESG Enhanced, HSBC Thematic or HSBC Impact to an investment product, this does not mean that all individual underlying holdings in the investment product or portfolio individually qualify for the classification. Similarly, when we classify an equity or fixed income under an HSBC ESG Enhanced, HSBC Thematic or HSBC Impact category, this does not mean that the underlying issuer’s activities are fully aligned with the relevant ESG product or sustainable characteristics attributable to the classification. As such, an SI classification does not mean that all underlying holdings in a fund meet the relevant sustainable investment criteria. Not all investments, portfolios or services are eligible to be classified under our ESG and SI classifications. This may be because there is insufficient information available or because a particular investment product does not meet HSBC’s SI classifications criteria.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability